Updated By: LatestGKGS Desk

Sahaj & Sugam income tax return filing form process from 1st Apr

Sahaj and Sugam income tax return filing form details

Income Tax department makes filing Income tax return for salaried class much easier than before from 1st April 2017. Income tax department has removed many points from old from making it better and easy for filling return.

Income tax department has named this form for slaried class as Sahaj. Sahaj includes only those points which are generally comes in use during filling the return income tax chapter 6-A.

As per income tax department officials, Sahaj includes those points which falss under income tax 80C, 80D. Under Sahaj people who want personal head for deduction can select as per thier choice.

These forms are available on incometax department official website. There are from ITR-1 to ITR-6 forms available on website. This is one of the step to encourage people for filing return.

E-filing for Income tax return is available from 1st April 2017 to 31st July 2017.

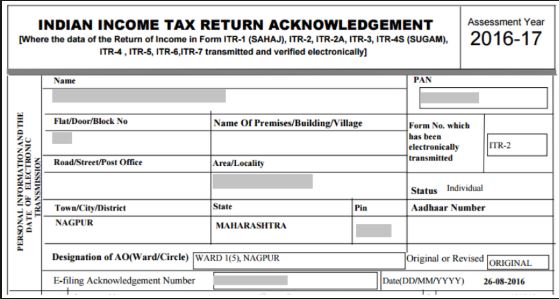

Income tax payee need to give their PAN, Aadhar, personal information at the time of return. Tax and TDS information will automatically reflect in the form. Aadhar is mandatory for all tax payee from 1st July.

E-filing website is equipped with a tax calculator.

People who are salaried and their income is fixed can use Sahaj form. People from Business secotr with approximate earning can use Sugam form for filing their incoe tax return.